Domestic Chicken Product Prices Rise by 200 CNY/Ton in a Single Day in 2025: Bullish Market Sentiment Prevails, North-South Supply-Demand Pattern Differentiates

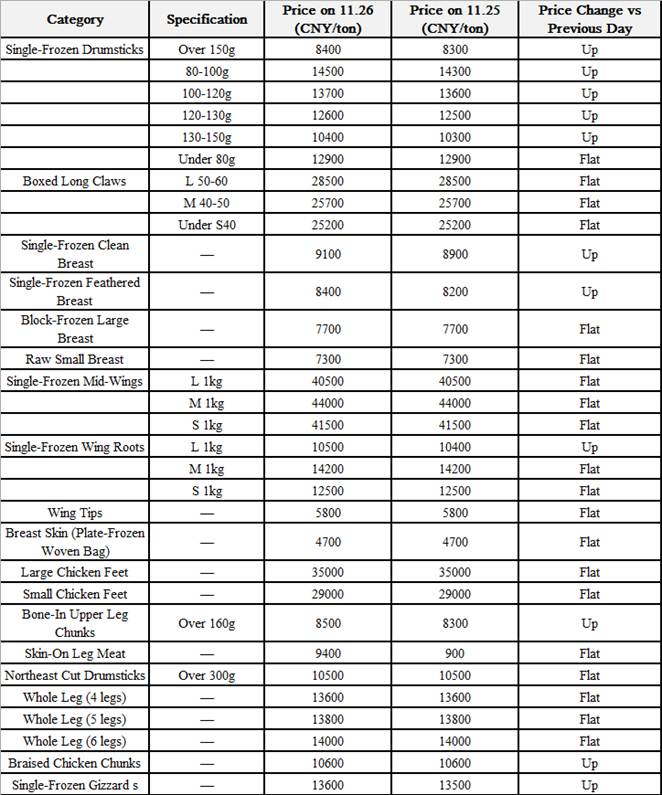

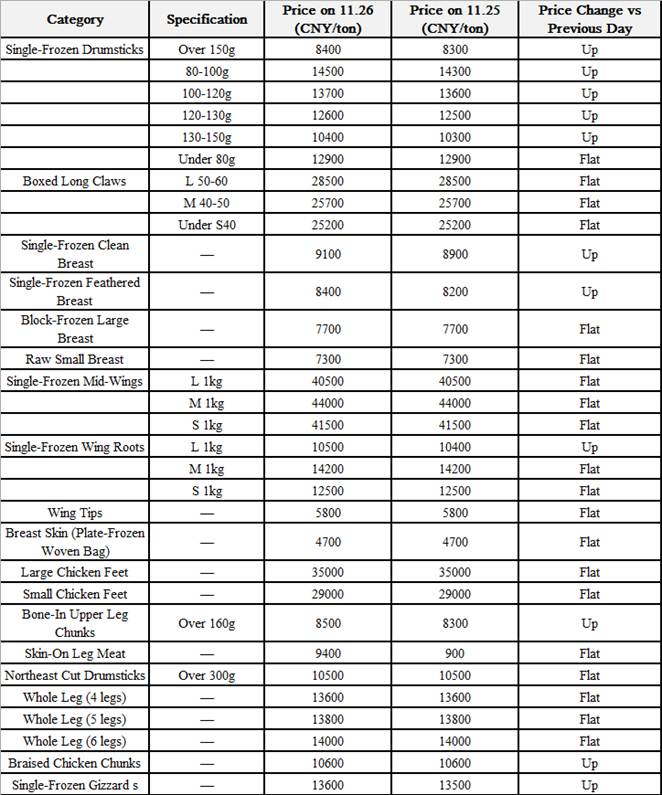

Chicken Product Prices Rise by Another 200 CNY/Ton; Bullish Sentiment Dominates the Market

Core Market Trend

Recently, the prices of chicken by-products have shown a noticeable spot-based increase. Among them, domestic breast meat products have performed strongly, with a single-day price rise of 100-200 CNY/ton; drumsticks and catering-use leg meat have also increased in price simultaneously, while the quotations of some individual products remain stable. In addition, in the poultry industry chain, the prices of broiler chickens and chicken seedlings have both shown a steady upward trend.

Detailed Analysis

1. Broiler Chicken Market: Supply-Demand Differentiation Between North and South, Slight Short-Term Fluctuations

Current Quotations: The national average price of broiler chickens at the farm gate remains stable at 3.5 CNY/catty, with quotations in Liaoning Province ranging from 3.55 to 3.6 CNY/catty.Supply-Demand Pattern: In northern production areas, the supply of broiler chickens for slaughter is sufficient. However, the stock of local broiler chickens in southern regions is relatively tight, especially the shortage of high-quality broiler chickens of large specifications. Coupled with the impact of chicken diseases, farmers are forced to slaughter chickens in advance, which further exacerbates the supply gap of large-sized chickens. Slaughtering enterprises have secretly increased prices to compete for supply.

Future Forecast: Currently, the sales speed of segmented products in the wholesale market is average, and the inventory of slaughtering enterprises is at a high level, so their willingness to maintain high prices is insufficient. It is expected that the price of broiler chickens will mainly fluctuate slightly in the short term.

2. Chicken Seedling Market: Recovery in Stocking Willingness, Limited Room for Price Increase

Price Trend: The price of chicken seedlings has increased in line with the market trend of broiler chickens.Supply Situation: Leading chicken seedling enterprises in Shandong, Liaoning and other regions have scheduled their seedling arrangement plans until early December, and the overall market supply is sufficient.Supporting Factors: The recovery of stocking willingness among large-scale breeding farms and slaughtering enterprises provides support for the price increase of seedlings.Restrictive Conditions: The current high incidence of chicken diseases has led to an increase in the mortality rate of breeding, making farmers cautious about stocking, which will limit the room for the price increase of seedlings in the short term.

China Becomes the Main Market for Colombia's Beef Exports

Core Information

Export Data: From January to September 2025, Colombia exported 25,105 tons of beef to more than 20 countries, earning 121.5 million US dollars, which has exceeded the total export volume of 2024 (106.5 million US dollars) and reached a record high.Main Markets: China, Algeria, Russia, Chile and El Salvador are the main buyers. Among them, the import volume of the Chinese market reached 14,523 tons, with an import value of 70 million US dollars, accounting for more than half of the total value of Colombia's beef exports and becoming the core driving force.Industry Outlook: Rafael, Executive Chairman of the Colombian National Cattle Federation, said that the international market's trust in Colombia's meat and dairy products continues, and the industry has a promising prospect.

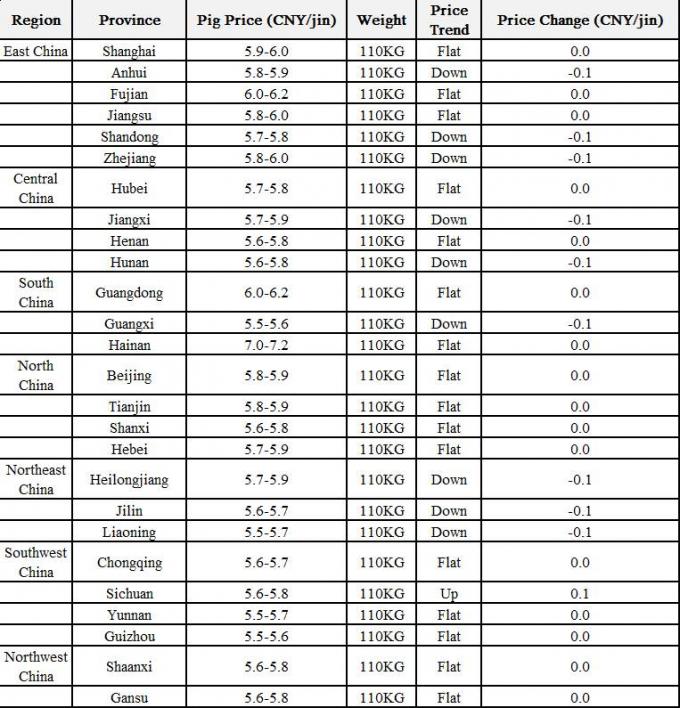

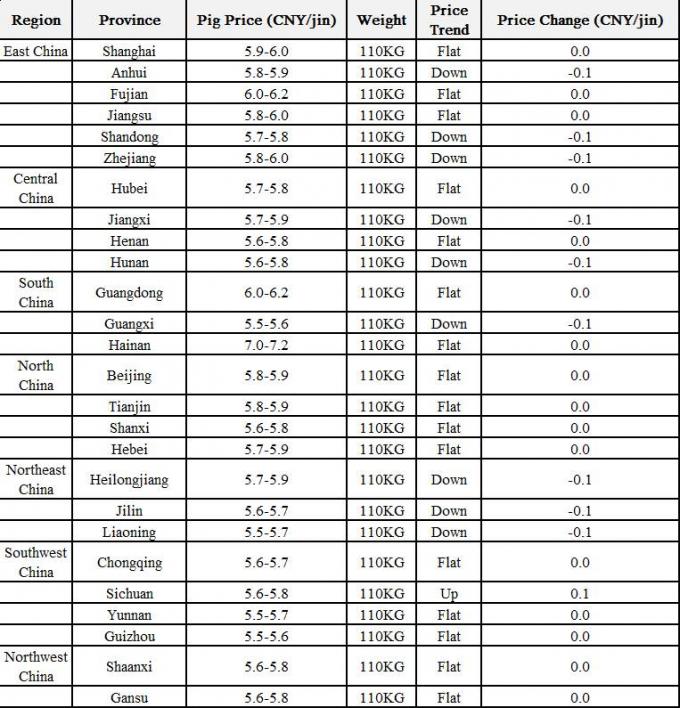

Pork Prices Fluctuate Weakly in November 2025; Phased Weak Rebound May Occur at the End of the Year

As of mid-November 2025, the domestic pork price has generally shown a weak fluctuating trend. Although the current pork price is suppressed by the problem of supply-demand mismatch, the industry expects that the peak consumption season at the end of the year is expected to bring a phased rebound opportunity for pork prices. However, the medium and long-term rebound range will be restricted by the problem of overcapacity.

From the supply side, the current live pig market shows an obvious situation of overcapacity. The stock of breeding sows is at a high level, and this situation continues to support the number of live pigs slaughtered. Data shows that the number of live pigs slaughtered in October increased by 3.2% year-on-year, and the average daily slaughter volume of leading pig enterprises even exceeded 13.9 million heads. At the same time, large-sized live pigs are being released in a concentrated manner in the market, and the transaction price of some large pigs over 300 catties is only 6.3-6.4 CNY/catty, which further exacerbates the supply pressure in the market.

The weak demand side has further suppressed the recovery of pork prices. Affected by the high temperature, the traditional cured meat demand in southern regions has been delayed. In northern regions, the purchase of New Year pigs has not increased significantly. Due to insufficient demand, the operating rate of slaughtering enterprises is currently only maintained at 25%-30%, which is significantly lower than the same period in previous years. In addition, the current inventory rate of frozen pork has reached a relatively high level of 20.03%, which also restricts the consumption of fresh pork.

For the future trend of pork prices, the market has a clear phased judgment. In the short term, from late November, the pork price is likely to continue the weak fluctuating trend. The pork price in some low-price regions may even drop to 5.5 CNY/catty. However, the sentiment of farmers to resist price declines is expected to play a certain role in limiting the decline range of pork prices.

In the medium and long term, from December to before the Spring Festival, with the drop in temperature, the cured meat demand in southern regions will gradually start, and the operating rate of slaughtering enterprises is expected to rise to more than 40%. The pork price is expected to usher in a phased weak rebound. However, since the pattern of overcapacity in live pigs has not been fundamentally changed, the range of this rebound will be very limited. It is expected that the national average price of standard pigs will fluctuate in the range of 5.5-6.5 CNY/catty.

Maxport Daily

2025/11/27

Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!  Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!